Fields of Activity

Architectural Glass

10 production facilities in six countries

Şişecam holds a pioneering position in Türkiye and globally with its advanced technology and innovative approaches.

ACTIVITIES IN 2023

Despite signs of economic recovery around the world, ongoing inflationary pressures and responsive measures to mitigate inflation limited global growth this year. By closely monitoring global developments and effectively managing uncertainties, Şişecam successfully overcame difficulties and maintained its leading position in all markets.

In Türkiye, the earthquake disaster and the sharp rise in interest rates as part of the fight against inflation suppressed economic growth at the start of 2023. Imports from countries with lower labor and energy costs such as China, along with the effect of the stable course of exchange rates, made for an especially challenging competitive landscape in the first quarter of the year. In 2023, Şişecam’s business partners, especially those located in the earthquake zone and indirectly facing difficulties, were provided with support. Proactive and rapid actions were taken to respond to competition created by imported products and to support the distribution channel that provides sustainable high quality service to the industry.

Industrial Glass

Uncompromising approach to customer satisfaction

In the industrial glass sector, Şişecam fulfills all industry requirements and expectations with its safe, high-quality products, supported by an open and innovative R&D ecosystem.

AUTOMOTIVE

ACTIVITIES IN 2023

In line with the vision of becoming a global leader, Şişecam Automotive meets all the requirements and expectations of the industry with safe and high-quality products thanks to its open and innovative R&D ecosystem.

GLASS FIBER

ACTIVITIES IN 2023

The Şişecam Glass Fiber production facility, commissioned in 2019 and equipped with the latest technologies, maintained its growth target in parallel with the developing composite industry.

Glassware

Market-driven product portfolio management

As a result of new product studies carried out by its glassware design team jointly with stakeholders, Şişecam received four awards in 2023.

ACTIVITIES IN 2023

Şişecam boasts long-term collaborations with its distributors and customers in the glassware segment coupled with an ability to develop innovative products by capitalizing on its advanced technical and design competencies. These competitive advantages play a key role in increasing Şişecam’s brand power and brand awareness in the global market.

Supported by its global production power, Şişecam reinforced its leading position in the glassware industry with more than 100 new products developed in 2023. Evolving market demands were closely analyzed to develop innovative products that stand out from the competition. Şişecam recorded a significant improvement in the service level offered to customers via effective management of its production capacity.

Glass Packaging

Leading position in its markets of operation

Şişecam ranks among the top five producers in Europe and globally.

ACTIVITIES IN 2023

Şişecam is the leader in the glass packaging industry in Türkiye and Russia and ranks among the top five manufacturers in Europe and worldwide. This reporting year, Şişecam moved forward with its glass packaging activities despite various macroeconomic and geopolitical challenges. In 2023, Şişecam recorded net sales revenue in its glass packaging segment of TRY 28.4 million.

Acting with the responsibility of being the industry’s main glass packaging supplier in Türkiye, Şişecam remained the driving force in Turkish glass packaging exports in 2023. Meeting local demand with its high-quality, wide product range and customeroriented management, Şişecam plans to boost exports from Türkiye and expand in the global market, especially in Europe.

Chemicals

One of the world’s two largest soda producers

Şişecam is one of the world’s two largest soda producers, with an annual soda production capacity of 5 million tons.

SODA

ACTIVITIES IN 2023

As one of the world’s largest soda producers, boasting a 5 million ton production capacity, Şişecam is recognized around the world as a reliable supplier with its high production capacity, high product quality, and extensive marketing network.

CHROMIUM

ACTIVITIES IN 2023

With the advantage of being the world’s leading chromium chemicals producer, Şişecam Chromium Chemicals generated 85% of its sales revenues from international markets and delivered its products to 57 countries worldwide in 2023. Further bolstering its existing relationships with companies in the sectors it serves, Şişecam maintained its strong position in the market.

Energy

Electricity generation from renewable sources

Şişecam supplied a large proportion of its electrical energy needs in Türkiye by its own production.

ACTIVITIES IN 2023

Şişecam’s Mersin Cogeneration Power Plant, Thrace Power Plant, and Mersin Solar Power Plants produced a total of 920 GWh of electricity in 2023. In the same period, electricity consumption at Şişecam facilities in Türkiye amounted to 1,277 GWh. Şişecam supplied a large proportion of its electrical energy needs in Türkiye by its own production.

In 2023, Şişecam’s energy trading company Şişecam Enerji A.Ş. traded 8,772 GWh of electricity and 1,359,000 m3 of natural gas. Some 95% of the turnover of this energy trade was realized with external customers other than Şişecam facilities.

Other

Seamless quality supply chain management

Şişecam concluded fiscal year 2023 with a total production of 3.7 million tons of glass sand, limestone, dolomite, feldspar, micronized products and kaolin.

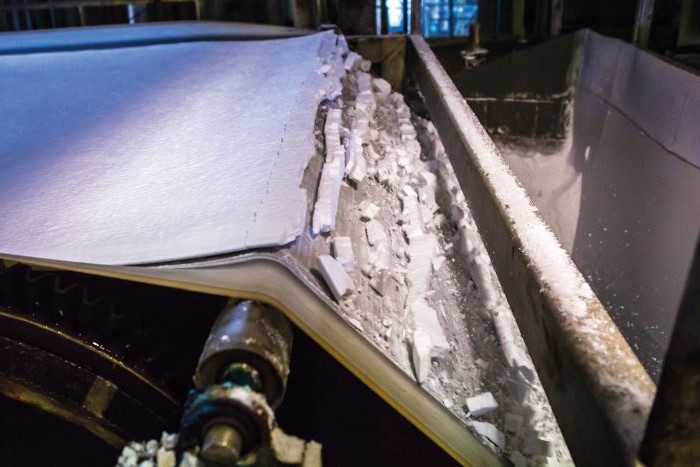

MINING

Şişecam managed without interruption its raw material quality and supply processes required for glass production with its mineral resources and raw material enrichment facilities. In 2023, Şişecam maintained its strong market position despite foreign exchange rate fluctuations and global risks.

CAMİŞ AMBALAJ

In 2023, Camiş Ambalaj maintained its leading position in the industry thanks to its exceptional services, quality, and reliability. In line with the economic and industrial developments throughout the year, sales remained at the same levels as in the previous year. The sales volume made outside Şişecam grew 3% compared to the prior year. In 2023, Camiş Ambalaj expanded its capacity by 14% with renewal and modernization investments.

OXYVIT

Following intense price competition in the feed industry throughout the year, prices fell and demand was postponed in all products that constitute an input to the industry. A contraction was experienced in the global market, especially Europe, but the South American and Asian markets were relatively less affected. While the industry experienced its lowest levels, signs of recovery emerged in the last months of 2023.